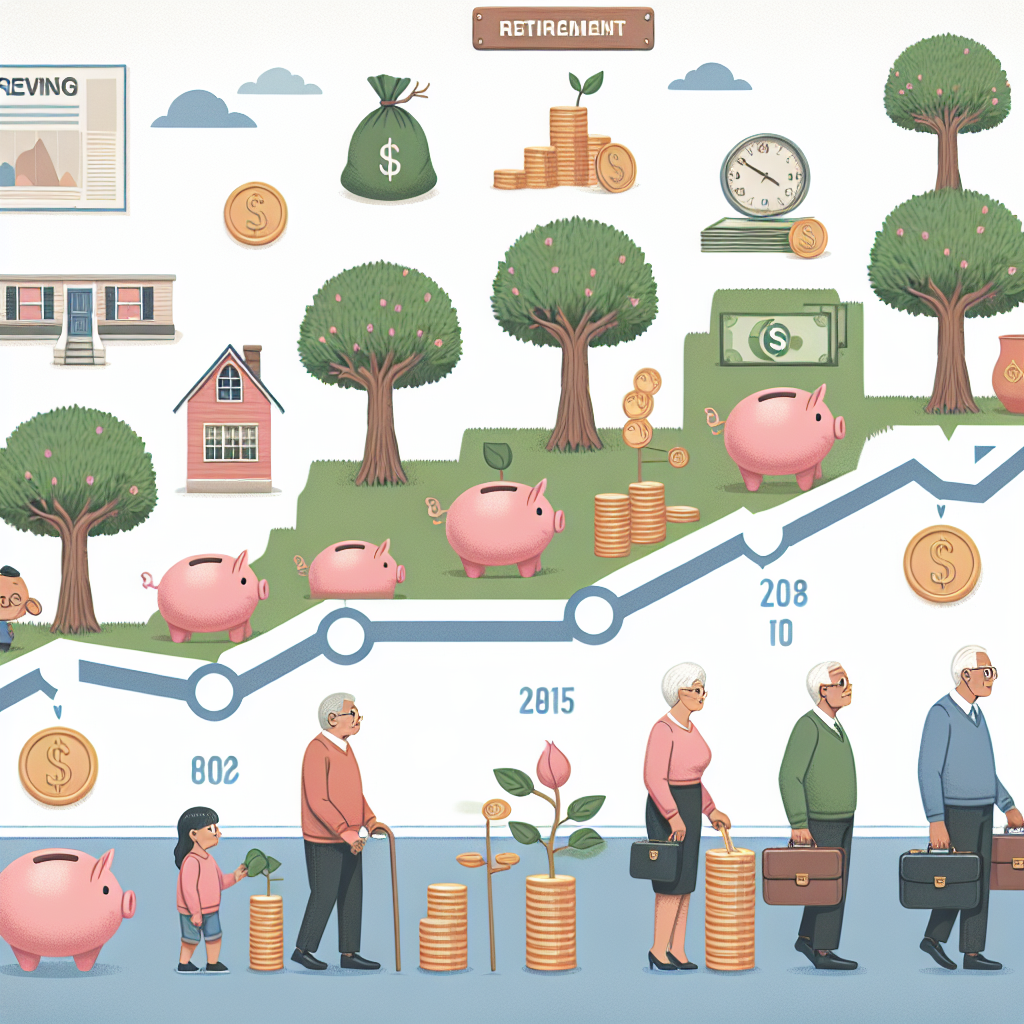

Long-Term Savings for Retirement

Long-term savings are funds set aside over an extended period to support you during retirement. You can start by contributing to retirement accounts like 401(k)s, IRAs, or personal investment portfolios. The key is to make regular contributions to allow your savings to grow over time.

Setting Retirement Goals

Establishing clear retirement goals helps you determine how much money you need to save and the lifestyle you want to maintain post-retirement. Factors to consider include living expenses, healthcare costs, travel plans, and any additional activities or hobbies you wish to pursue.

Exploring Investment Options

When planning for retirement, it's essential to consider various investment options to grow your savings. These options may include stocks, bonds, mutual funds, real estate, or retirement target-date funds. Diversifying your investments can help mitigate risk and optimize returns.

Understanding Pension Benefits

If you're entitled to a pension from your employer, take the time to understand the terms and benefits it offers. A pension provides a steady income stream during retirement based on your years of service and salary history. Knowing how your pension works can help you incorporate it into your overall retirement plan.

Conclusion

Retirement planning requires careful consideration of long-term savings, retirement goals, investment options, and pension benefits. By proactively managing these aspects, you can work towards a financially secure and fulfilling retirement.

For further information on retirement planning fundamentals, consult financial advisors, retirement planning books, and online resources.

References: https://www. example. com/retirement-planning-resources

.